The price information originates from the AAA Foundation for Website Traffic Security, as well as it represents any accident that was reported to the police. The ordinary costs data comes from the Zebra's State of Car Insurance coverage report. The costs are for plans with 50/100/50 liability insurance coverage limitations and a $500 insurance deductible for comprehensive and also collision protection. trucks.

According to the National Freeway Traffic Safety And Security Administration, 85-year-old men are 40 percent most likely to enter an accident than 75-year-old guys (low-cost auto insurance). Considering the table above, you can see that there is a straight connection between the accident rate for an age which age team's ordinary insurance costs.

cheap low cost prices insure

cheap low cost prices insure

cheaper cars liability auto insurance auto insurance

Bear in mind, you could locate much better prices with another business that does not have a certain trainee or senior discount rate. * The Hartford is just offered to members of the American Association of Retired Persons (AARP). However, policyholders can add younger motorists to their plan and also obtain discount rates. Typical Cars And Truck Insurance Coverage Rates And Also Cheapest Provider In Each State Since vehicle protection rates differ a lot from one state to another, the service provider that supplies the cheapest vehicle insurance in one state might not provide the most affordable insurance coverage in your state.

You'll additionally see the ordinary cost of insurance policy because state to assist you contrast. The table also consists of rates for Washington, D.C. These price estimates relate to 35-year-old vehicle drivers with excellent driving documents and credit. As you can see, average auto insurance coverage prices vary extensively by state. Idahoans pay the least for car insurance, while drivers in Michigan shell out the big dollars for protection - cheap.

If you live in downtown Des Moines, your premium will most likely be greater than the state standard. On the other hand, if you reside in upstate New York, your auto insurance coverage will likely set you back less than the state standard. Within states, cars and truck insurance coverage costs can vary commonly city by city.

The Of New Cars, Used Cars For Sale, Car Reviews And Car News

However, the state isn't one of one of the most expensive general. Minimum Protection Demands A lot of states have monetary responsibility regulations that need motorists to carry minimum cars and truck insurance policy coverage. You can only bypass insurance coverage in 2 states Virginia and also New Hampshire yet you are still financially in charge of the damage that you trigger.

No-fault states consist of: What Various other Aspects Impact Auto Insurance Policy Fees? Your age as well as your house state aren't the only points that impact your rates. insurance company. Insurance firms make use of a selection of aspects to establish the cost of your premiums. Right here are several of one of the most essential ones: If you have a tidy driving document, you'll discover better rates than if you have actually had any type of recent crashes or traffic violations like speeding tickets.

Some insurance providers may provide affordable rates if you do not use your vehicle a lot - cheaper car. Others provide usage-based insurance that might save you cash. Insurance companies factor the chance of a car being swiped or harmed in addition to the expense of that car right into your costs. If your car is one that has a possibility of being stolen, you might have to pay more for insurance coverage.

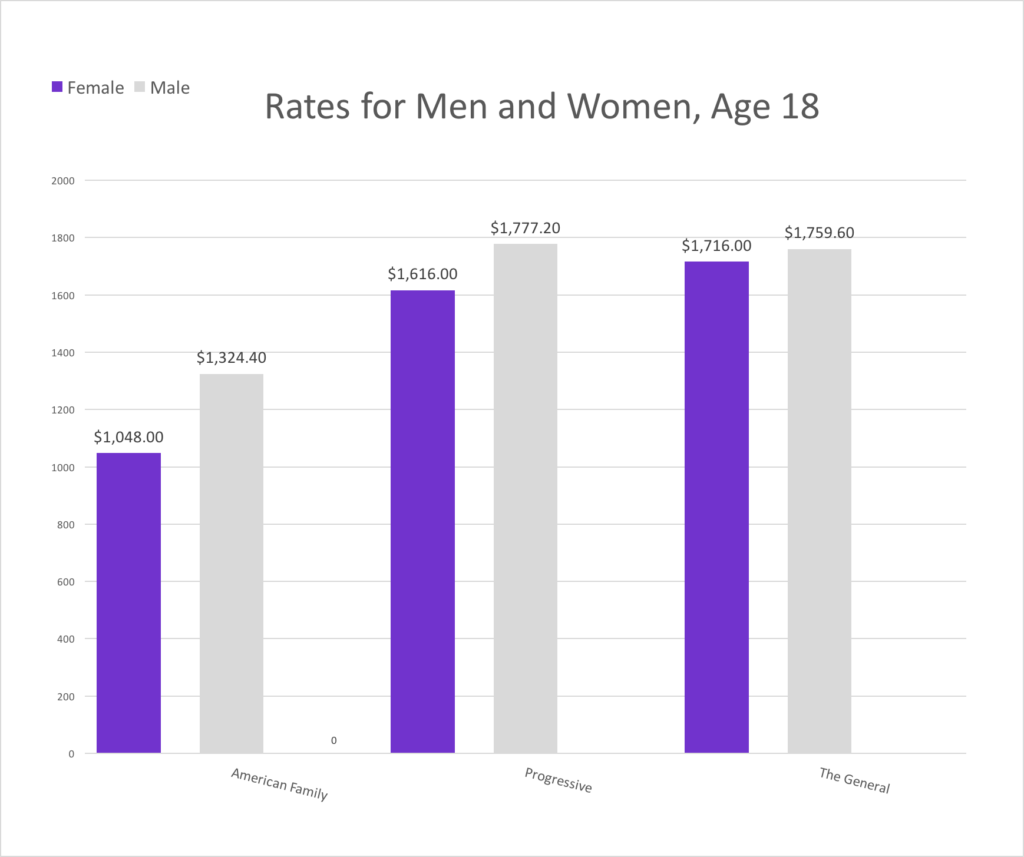

Yet in others, having bad credit history can trigger the cost of your insurance coverage costs to rise significantly. Not every state permits insurance firms to utilize the gender detailed on your vehicle driver's license as an identifying consider your costs. Yet in ones that do, female vehicle drivers typically pay a little much less for insurance coverage than male chauffeurs.

Plans that just meet state minimum insurance coverage needs will be the least expensive. Extra protection will certainly set you back even more. Why Do Automobile Insurance Prices Change? Considering ordinary automobile insurance coverage rates by age and state makes you wonder, what else impacts prices? The answer is that auto insurance rates can alter for numerous reasons (vehicle insurance).

See This Report about Former Citadel Student Gets $275,000 Pay-out From State ...

An at-fault crash can elevate your rate as high as half over the following 3 years. If you were convicted of a DUI or perpetrated a hit-and-run, your rates will rise much more. You don't have to be in a mishap to experience climbing rates. Overall, car insurance coverage often tends to get extra costly as time takes place.

Fortunately, there are a number of other price cuts that you could be able to maximize today - cheapest auto insurance. Here are a few of them: Several firms give you the biggest price cut for having an excellent driving background. Additionally called packing, you can obtain lower rates for holding even more than one insurance coverage with the exact same company.

/GettyImages-1004420614-d368080d9b9742c2a9b97753639288ec.jpg) affordable car insurance insurance vans cheaper cars

affordable car insurance insurance vans cheaper cars

cheap car car insurance insure

cheap car car insurance insure

Property owner: If you possess a residence, you could get a property owner discount rate from a variety of providers. insurance companies. Get a discount for sticking to the exact same firm for numerous years. Here's a trick: You can always contrast prices each term to see if you're getting the finest rate, despite having your loyalty price cut.

Nevertheless, some can also elevate your prices if it turns out you're not an excellent driver (car). Some companies provide you a discount rate for having a great credit history. When browsing for a quote, it's a great idea to call the insurance coverage business as well as ask if there are anymore discount rates that put on you.

Insurify conducted a research study of hundreds of thousands of quotes for adolescent motorists to establish the average monthly expense of car insurance policy, and they discovered that the rates were greater than the standard for all various other United state

The typical full insurance coverage car insurance policy rate for a 20-year-old man is concerning $3,600. credit score. Cost for All 19 years-olds If you're a 19-year-old, you pay high rates for automobile insurance coverage.

The average cost of complete coverage for a 19-year-old vehicle driver is $3,560, which is a lot more than $1,800 higher than the nationwide average for motorists age 30 (insurance).

The various other variables that generally influence premiums are: Marital standing, Location, Gender, Credit history rating, Driving history, Lorry make and design Insurance policy for a 19-year-old is normally expensive, not just because of the motorist's age yet other aspects that likely relate to young adults. low-cost auto insurance. Youthful chauffeurs generally have short driving backgrounds and reduced credit report.

Visit the website >The Ultimate Guide To The Cheapest Car Insurance For College Students

Source URL Ordinary Expense for 19-year-olds vs 16-year-olds A 19-year-old will pay concerning $2,500 much less for vehicle insurance than a 16-year old will. Resource URL Ordinary Expense for 19-year-olds vs 18-year-olds Car insurance coverage for 19-year-olds is a lot more expensive than it is for the typical driver, however is far much less than that of 18-year-old drivers by themselves plan.

com, Men pay approximately $5,605 for their very own complete insurance coverage plan, which is $833 even more than women. Resource URL, Source link A Lot Of Pricey as well as Least Expensive States The for 19-year-old motorists is, with an average cost of $1,490 every year for full protection and $550 annually for minimal coverage.

Both New York as well as New Jacket are no-fault states, as well as while New Jersey has the highest possible populace thickness in the country, New York motorists typically fall victim to insurance fraud.