- In short, there is no insurance deductible in a liability insurance claim. - A couple of states provide the choice of choosing a $0 insurance deductible on comprehensive insurance.

Some insurance provider (like Progressive), deal this in cases where glass repair is possible. vans. It is essential to select the appropriate auto insurance deductible Ensure you choose the most effective vehicle insurance coverage deductible for your demands. Don't forget to consider your out-of-pocket capabilities, your car's worth, and the sort of protection.

When it involves automobile insurance policy, a deductible is the amount you 'd have to pay of pocket after a protected loss before your insurance protection begins. Auto insurance coverage deductibles function in a different way than clinical insurance deductibles with auto insurance, not all sorts of coverage need a deductible (cheapest car). Liability insurance policy does not require an insurance deductible, yet detailed and accident coverage usually do. low cost.

When you're adding that protection to your auto insurance coverage, you'll typically have the opportunity to decide where you intend to establish the deductible. cheaper auto insurance. Commonly, the greater you set your insurance deductible, the reduced your month-to-month insurance policy costs will certainly be but you do not wish to establish it so high that you would not have the ability to actually pay that quantity if required.

What does an automobile insurance policy deductible mean? A insurance deductible is the amount of money you have to pay of pocket before your automobile insurance will cover the rest. For instance, if you backed your vehicle into an utility pole, your crash insurance would spend for the price of the damage (laws).

Our Car Insurance Deductibles Guide: 5 Key Things To Know In 2022 PDFs

automobile car cheap auto insurance accident

automobile car cheap auto insurance accident

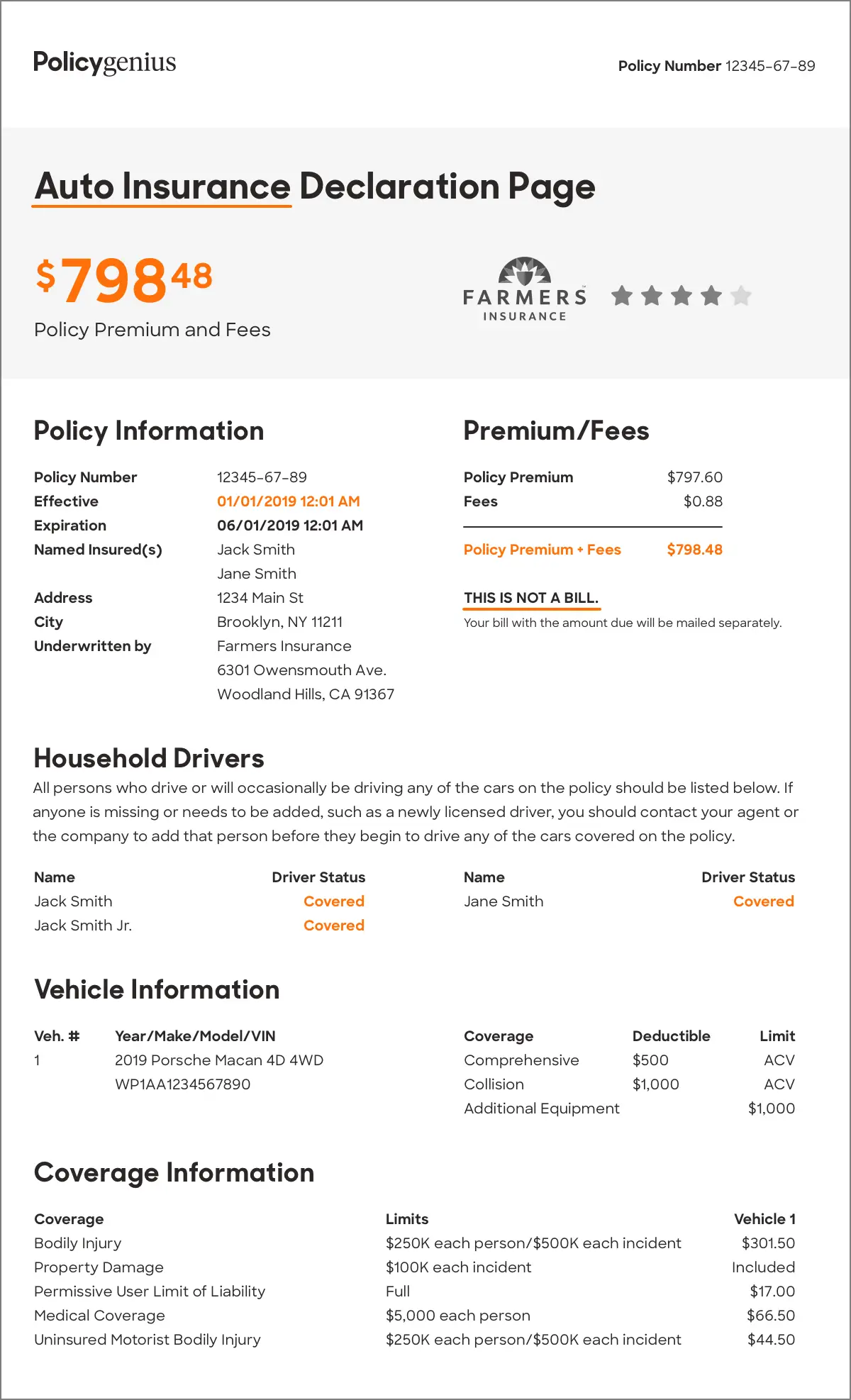

If the overall cost of repairs pertains to $1800, your insurance policy will only spend for $1300. liability. You can discover your deductible quantities is listed on your declarations page. credit. Needing to pay an insurance deductible ways you can do a type of cost-benefit evaluation before you make an insurance claim with your insurer.

What kind of protection needs a deductible?, which covers the costs if you harm a person's building or wound somebody with your cars and truck, never ever calls for an insurance deductible., and where you establish your insurance deductible will have an affect on your month-to-month insurance policy costs.

The reverse is additionally real, choosing a low insurance deductible means you'll have to pay a higher premium., however bear in mind, there's a really actual opportunity you'll have to pay that insurance deductible sooner or later - auto insurance.

You are in charge of the very first $1,000 of damages and your insurance company is responsible for the various other $1,000 of covered damages. low cost. Crash and also extensive are the 2 most common coverages with an insurance deductible. auto insurance. Collision-- this protection aids pay for damages to your vehicle if it strikes one more cars and truck or things or is hit by another vehicle.

A Biased View of How Much Car Insurance Do I Need? - Ramseysolutions.com

There are additionally some other points to find out about deductibles. There are no deductibles for obligation insurance coverage, the insurance coverage that pays the various other individual when you cause a mishap. Car insurance policy deductibles apply to each mishap you remain in. If you get into 3 mishaps in a policy duration and have a $500 deductible, you'll generally be liable for $500 for each case.

insurance company affordable auto insurance cheapest auto insurance car insurance

insurance company affordable auto insurance cheapest auto insurance car insurance

credit perks insure cheap

credit perks insure cheap

Speak to your Tourist's agent or independent agent, regarding the very best means to cover your https://s3.ap-northeast-2.wasabisys.com vehicle. What is a Vehicle Insurance Policy Deductible? Your car insurance deductible is the amount you'll be accountable for paying in the direction of the prices due to a loss before your insurance protection pays. The lower the insurance deductible, the much less you'll pay out of pocket if a case occurs.

Picking a greater insurance deductible might reduce your auto insurance costs. But it is necessary to pick an insurance deductible you can afford in the event of a loss. Speak with your local independent representative or Travelers depictive regarding the insurance deductible options available to you. When Do You Pay an Auto Insurance Policy Deductible? Anytime you go to your very own insurance provider to file a case for damages to your protected vehicle, a deductible will apply whether you are at mistake or otherwise.

What Are Obligation Restrictions as well as How Do They Function? Your automobile insurance coverage liability coverage restrictions, additionally referred to as restriction of obligation, are the most your insurance coverage will certainly pay to an additional party if you are legally accountable for a mishap. Umbrella policies are not needed as well as available insurance coverage limitations and eligibility requirements may vary by state.

All About How Much Car Insurance Do I Need? - Ramseysolutions.com

A deductible is what you pay out of pocket to fix your auto before your cars and truck insurance pays for the rest. If you lug detailed and also accident coverage on your auto insurance coverage, you will certainly see a deductible provided on your plan as a buck amount.

When do you pay your insurance deductible? You just pay the deductible for repair work made to your very own automobile. Nonetheless, you don't pay a deductible for other lorries involved in the collision, also if you are discovered responsible. However, there are some exemptions to paying a deductible for damage to your lorry.

How much will you conserve each year on premiums? Would these cost savings make a meaningful influence on your budget plan? This is where the worth of your car can be a large element. More recent cars are much more expensive to change than older lorries. Therefore alone, you may see a big price dive in your premium if you go with the reduced deductible.

cheaper car business insurance auto cheaper car

cheaper car business insurance auto cheaper car

If you're still leaning toward a higher deductible, assume concerning this: How long would certainly it take to recoup what you'll spend on premium expenses? If it's just mosting likely to take you a year or more, the higher deductible may still be looking great - car insured. Otherwise, the reduced insurance deductible may make more sense.